Are you searching for the perfect accounting software to simplify your business finances? Xero Accounting Software has become a popular choice, but does it really live up to the hype?

You’ll find honest and detailed Xero accounting software reviews that help you understand its features, benefits, and potential drawbacks. By the end, you’ll know if Xero is the right fit for your needs and how it can make managing your accounts easier and more efficient.

Keep reading to make a smart choice for your business.

Xero Features

Xero offers a range of features designed to simplify business accounting. It suits small to medium businesses well. The software helps manage finances clearly and efficiently. Users can handle daily tasks without much hassle.

The features focus on core accounting needs. Each tool works to save time and reduce errors. Here is a look at some key features of Xero.

Invoicing And Billing

Xero makes creating invoices easy and fast. Users can customize invoices with their logo and details. It sends invoices directly by email to customers. Payment reminders are automatic, helping to get paid on time. The system tracks which invoices are paid or overdue.

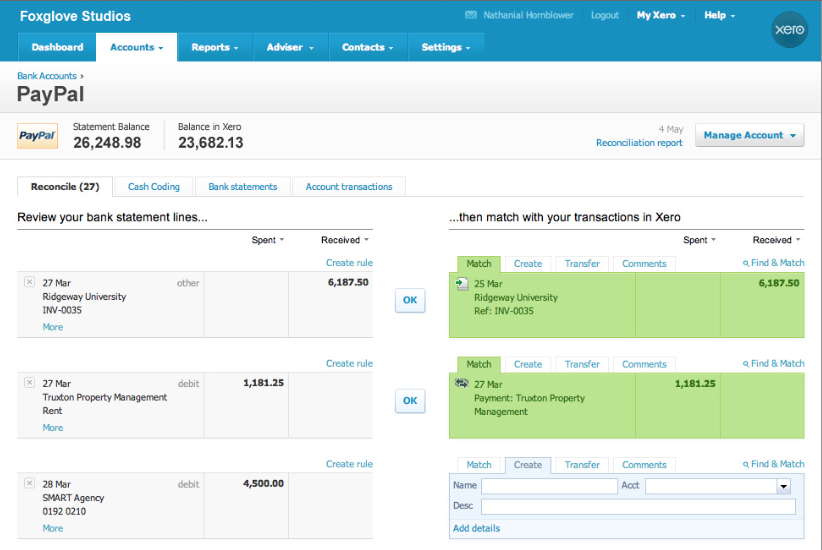

Bank Reconciliation

Bank reconciliation is simple with Xero. It connects directly to your bank accounts. Transactions download automatically every day. You can match bank entries to invoices or bills quickly. This feature reduces manual entry and mistakes.

Expense Tracking

Track expenses easily using Xero’s tools. You can upload receipts by phone or computer. Expenses categorize automatically for accurate reports. The system helps control spending and monitor cash flow. It also supports multiple currencies for global businesses.

Inventory Management

Xero includes basic inventory management features. Users can add product details and track stock levels. It updates inventory automatically when sales or purchases happen. Alerts notify when stock runs low. This helps avoid running out or overstocking.

Payroll Integration

Xero integrates payroll with accounting seamlessly. Pay employees and manage taxes from one place. The system calculates wages, deductions, and benefits automatically. It keeps payroll records organized and compliant. This integration saves time and reduces errors.

Credit: www.softwareadvice.com

Pricing Plans

Xero offers several pricing plans to fit different business needs. Each plan includes key features to help manage accounting tasks efficiently. Understanding these plans helps you pick the right one for your budget and business size.

Starter Plan

The Starter Plan is designed for small businesses and freelancers. It allows you to send up to 20 invoices and quotes per month. You can enter up to 5 bills and reconcile bank transactions. This plan suits businesses with simple accounting needs.

Standard Plan

The Standard Plan includes all Starter features. It removes limits on invoices, bills, and reconciliations. You can manage payroll for up to 20 employees. This plan fits growing businesses with more complex needs.

Premium Plan

The Premium Plan supports larger teams with payroll for up to 50 employees. It offers multi-currency accounting for international business. You get priority support and additional reporting tools. This plan is ideal for established businesses.

Add-ons And Extras

Xero provides extra tools like payroll, expenses, and project tracking. These add-ons integrate smoothly with your main plan. They help customize your accounting to match specific business needs. Choose add-ons to enhance productivity and control.

User Experience

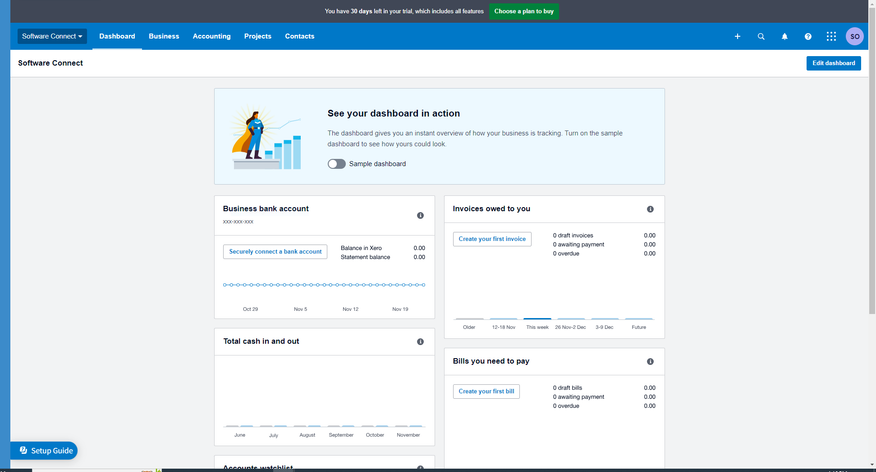

User experience plays a big role in choosing accounting software. Xero aims to make accounting simple and clear. The software focuses on easy use and smooth operation for all users. This section reviews the user experience of Xero, covering the interface, mobile app, and support.

Interface And Navigation

Xero has a clean and tidy interface. The dashboard shows key information at a glance. Menus are easy to find and use. Users can move between tasks quickly. Simple icons help users understand options fast. Even beginners can handle the system with little help.

Mobile App Functionality

The Xero mobile app works well on phones and tablets. It lets users check accounts and send invoices anywhere. The app syncs with the desktop version smoothly. It offers essential features without complexity. Users appreciate the ability to manage finances on the go.

Customer Support

Xero provides helpful customer support. The team responds quickly through chat and email. There is a large online help center with guides and videos. Users can find answers without waiting. Support is clear and easy to understand for all users.

Credit: softwareconnect.com

Pros And Cons

Choosing the right accounting software is important for any small business. Xero is popular and has many features. It also has some drawbacks. Knowing the pros and cons can help make a better decision. This section breaks down the main advantages and limitations of Xero.

Advantages For Small Businesses

Xero is easy to use and has a clean interface. It helps track expenses, invoices, and payments quickly. The software supports multiple users, which is helpful for teams. It connects with many banks to import transactions automatically. Reports are clear and useful for business insights. Xero also offers mobile apps for managing accounts on the go. Its cloud-based system means you can access data anytime and anywhere. Customer support is responsive and helpful. The software updates regularly to improve features and security.

Limitations To Consider

Xero can be costly for very small businesses or startups. Some users find the learning curve steep at first. The payroll feature is limited to certain countries. Advanced inventory management is not available in all plans. Customizing reports can be tricky without extra training. Offline access is not possible since it’s cloud-based. Integration with some third-party apps may be limited. Some users report occasional syncing issues with bank feeds. The software may not suit businesses with complex accounting needs.

Comparisons With Competitors

Choosing the right accounting software is important for small businesses. Many options exist, but Xero stands out. Comparing Xero with its top competitors helps understand its strengths and weaknesses. This guide covers two popular choices: QuickBooks and FreshBooks.

Xero Vs Quickbooks

Xero offers a clean, easy-to-use interface. It focuses on cloud-based accounting with strong bank integration. QuickBooks has more features for larger businesses. It provides detailed reports and inventory management.

Xero allows unlimited users on all plans. QuickBooks limits users based on the plan. Xero’s pricing is simpler and often cheaper for small teams. QuickBooks offers more training and customer support options.

Both support invoicing and expense tracking well. QuickBooks has stronger payroll features. Xero integrates better with third-party apps. Small businesses may prefer Xero for simplicity and cost.

Xero Vs Freshbooks

FreshBooks focuses on invoicing and time tracking. It suits freelancers and service providers well. Xero provides full accounting features beyond invoicing.

Xero supports inventory, payroll, and multi-currency transactions. FreshBooks is simpler but lacks some accounting tools. FreshBooks has a more user-friendly interface for beginners.

Xero handles bank feeds and reconciliations better. FreshBooks offers better client communication tools. Pricing is similar, but Xero supports more users.

For detailed accounting, Xero is better. FreshBooks works well for billing and time tracking needs.

Security And Compliance

Security and compliance are vital for any accounting software. Xero understands the need to keep your financial data safe and follow legal rules. This section covers how Xero protects your data and meets important regulations.

Data Protection Measures

Xero uses strong encryption to keep your information private. All data is encrypted during transfer and storage. This helps prevent unauthorized access to your financial details.

The software also has multiple layers of security. It includes firewalls, secure servers, and regular security tests. Xero monitors its systems 24/7 to detect any unusual activity quickly.

Access controls limit who can see or change your data. You can set user permissions to keep control over sensitive information. Two-step verification adds an extra layer of login security.

Regulatory Compliance

Xero follows important laws and regulations worldwide. It complies with GDPR rules to protect personal data in Europe. The software also meets standards like SOC 2 for data security.

Regular audits check that Xero keeps up with compliance requirements. This helps maintain trust and transparency with users. The company updates its policies to stay current with changing laws.

By using Xero, businesses can meet tax and financial reporting rules more easily. The software supports compliance with local tax laws across many countries.

Tips For Getting Started

Starting with Xero accounting software can feel confusing. Simple steps can make the process smooth and quick. Focus on key tasks first. This helps you use the software with confidence and ease.

Setting Up Your Account

Create your Xero account by entering basic information. Choose your business type and currency carefully. Set up your users and assign roles for team members. This keeps your data secure and organized. Follow the setup checklist in Xero for better guidance.

Importing Financial Data

Gather all your financial records before importing. Xero supports importing bank statements, invoices, and bills. Use the CSV file format for easy uploading. Double-check your data for accuracy to avoid errors. This step saves time on manual entry later.

Customizing Reports

Reports show your business health clearly. Choose the reports you need most, like profit and loss or balance sheets. Adjust report settings to match your business needs. Save custom reports for quick access. Regularly review reports to keep track of finances.

Credit: planyard.com

Frequently Asked Questions

What Are The Main Features Of Xero Accounting Software?

Xero offers invoicing, bank reconciliation, inventory management, payroll, and financial reporting. It supports multi-currency and integrates with over 800 apps. Its cloud-based platform ensures access anywhere with real-time data updates, making accounting efficient for small to medium businesses.

Is Xero Suitable For Small Businesses?

Yes, Xero is ideal for small businesses due to its user-friendly interface and affordable pricing. It automates many accounting tasks, saving time. Xero’s scalable features grow with your business, offering flexibility and comprehensive support for managing finances effectively.

How Secure Is Xero Accounting Software?

Xero uses 256-bit SSL encryption and multi-factor authentication to protect data. It stores data on secure servers with regular backups. Xero complies with global security standards, ensuring your financial information remains safe and confidential at all times.

Can Xero Integrate With Other Business Tools?

Yes, Xero integrates seamlessly with over 800 third-party apps, including payment processors, CRM, and inventory software. These integrations streamline workflows and enhance productivity. Businesses can customize their accounting system to fit specific needs and improve overall efficiency.

Conclusion

Xero offers many features that help manage business finances. It is easy to use and saves time. Many users find its tools helpful for tracking expenses and invoices. The software fits small to medium businesses well. Pricing options suit different budgets and needs.

Support is available to answer questions quickly. Overall, Xero provides solid accounting functions with user-friendly design. Try it to see if it matches your business needs. Simple, clear, and efficient—Xero helps keep accounts organized.