Are you searching for reliable accounting software that can simplify your business finances? You’ve probably heard about Xero, but is it the right fit for you?

We’ll dive deep into Xero accounting reviews to help you see how it performs in real-life situations. By the end, you’ll know if Xero can save you time, reduce stress, and keep your accounts in perfect order. Keep reading to discover what users really think and whether Xero matches your needs.

Xero Accounting Features

Xero offers a wide range of features designed to help small businesses manage their finances easily. Its tools simplify accounting tasks and save time. The interface is user-friendly, making it easy to navigate. Let’s explore some key features that stand out in Xero’s accounting software.

Invoicing And Billing

Xero lets you create and send professional invoices quickly. You can customize invoices with your logo and payment terms. The system also sends automatic reminders to customers. It supports multiple currencies for international clients. Online payment options help you get paid faster.

Bank Reconciliation

Bank reconciliation is simple with Xero. The software connects to your bank accounts securely. It imports transactions daily and matches them automatically. You can review and approve transactions in minutes. This feature reduces errors and keeps your records accurate.

Expense Tracking

Track business expenses easily using Xero. You can capture receipts by taking photos with your phone. Expenses can be assigned to different categories or projects. It helps you monitor where money is spent. This feature makes tax time less stressful.

Inventory Management

Xero offers basic inventory management tools. You can add products and track stock levels. It updates inventory automatically when you sell or buy items. Alerts notify you when stock runs low. This helps avoid overselling and keeps customers happy.

Payroll Integration

Xero integrates payroll features directly into the software. It calculates employee wages, taxes, and deductions automatically. Payslips are generated and sent to employees digitally. The system ensures compliance with tax laws. Payroll data syncs with accounting records seamlessly.

User Experience

User experience is a key factor in choosing accounting software. Xero aims to provide a smooth and efficient experience for all users. It focuses on simple design and clear navigation. Users can manage their finances without confusion or delay.

Ease Of Use

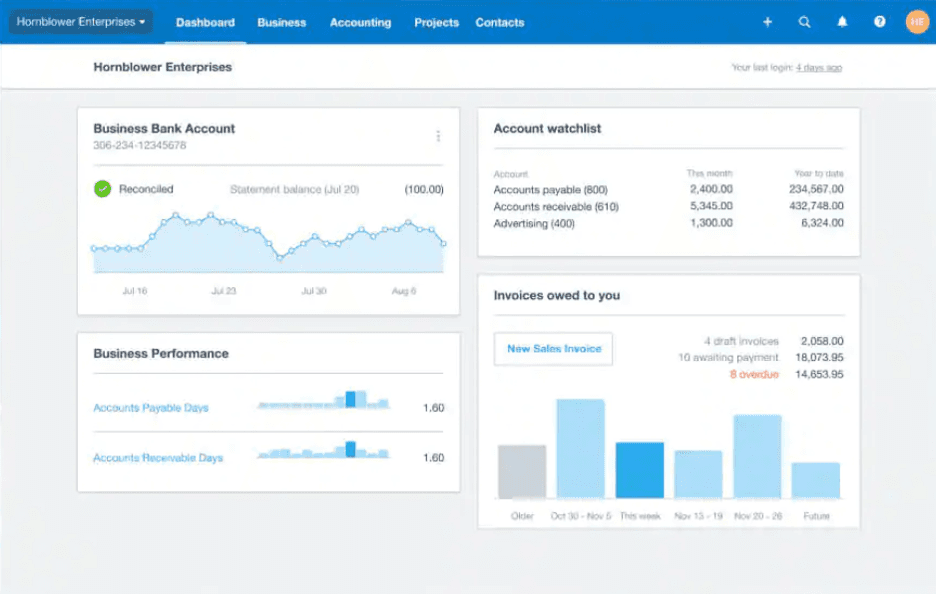

Xero has a clean and simple interface. Menus are easy to find and understand. Tasks like invoicing and bank reconciliation take few steps. Even beginners can start quickly. The dashboard gives a clear overview of financial health. It helps users stay organized and informed.

Mobile App Functionality

The Xero mobile app works well on smartphones and tablets. Users can send invoices and check accounts on the go. The app syncs automatically with the desktop version. It supports receipt capture and expense tracking. Small business owners find it very helpful for quick updates.

Customer Support

Xero offers several support options. There is a large online help center with guides and videos. Users can contact support by email or live chat. Response times are generally fast and helpful. The community forum also allows users to share tips. Support helps users solve problems and learn the software.

Pricing Plans

Xero offers a range of pricing plans to fit different business needs. Each plan varies in features and cost. This flexibility helps businesses choose what suits their size and requirements best.

Understanding the pricing structure is important before committing. This section breaks down the plan options, value for money, and available free trials or discounts.

Plan Options

Xero has three main plans: Starter, Standard, and Premium. The Starter plan is best for small businesses with simple needs. The Standard plan adds more features like invoicing and bill payments. Premium offers advanced tools and supports multiple currencies. Each plan supports a different number of users and transactions.

Value For Money

Xero’s plans are priced competitively compared to other accounting software. The features included in each plan give good support for managing finances. Businesses can save time and reduce errors with automation tools. The option to upgrade or downgrade plans adds flexibility. This helps businesses avoid paying for unused features.

Free Trial And Discounts

Xero offers a 30-day free trial for new users. This trial lets businesses test all features without a credit card. Discounts may be available for yearly subscriptions or through partners. Some regions have special promotions during certain times. Trying the software first helps decide if it matches business needs.

Credit: fitsmallbusiness.com

Security Measures

Xero Accounting places strong emphasis on security to protect your financial data. It uses several layers of security to keep information safe and private. This focus helps businesses trust Xero with their sensitive accounting details.

Data Protection

Xero uses encryption to secure data both in transit and at rest. This means your information is coded and unreadable to outsiders. The platform follows strict data privacy laws to guard your financial records. Regular security tests help find and fix weak spots quickly.

User Permissions

Xero allows account owners to control who can see and edit data. You can assign roles with specific access levels to team members. This limits the risk of unauthorized changes or data leaks. Clear permission settings help maintain control over your business information.

Backup And Recovery

Xero automatically backs up your data multiple times daily. This ensures your information stays safe even during technical issues. In case of a problem, you can restore data quickly from backups. This reduces downtime and prevents loss of important accounting records.

Comparison With Competitors

Choosing the right accounting software is essential for small businesses. Xero stands out but faces strong competition. Understanding how it compares helps in making a smart choice.

Feature Differences

Xero offers bank reconciliation, invoicing, and payroll. Its dashboard is clean and easy to use. QuickBooks provides more advanced tax tools. FreshBooks focuses on time tracking and billing. Xero supports multi-currency, unlike some competitors. Some rivals have stronger inventory features. Xero’s mobile app is highly rated for ease. Overall, Xero balances features well for small businesses.

Pricing Comparison

Xero’s plans start at a competitive price. It charges monthly, with no long-term contracts. QuickBooks offers similar pricing but limits users on cheaper plans. FreshBooks is slightly pricier but includes time tracking. Xero allows unlimited users on all plans. Some competitors charge extra for additional users. For cost-conscious businesses, Xero provides good value. Watch out for add-ons that may increase cost.

User Feedback

Users praise Xero for simplicity and cloud access. Many say customer service is helpful and quick. Some users find setup challenging at first. QuickBooks users like its robust reporting tools. FreshBooks customers appreciate its intuitive interface. Xero users highlight seamless bank integration. Common complaints include occasional software bugs. Overall, users trust Xero for daily accounting tasks.

Credit: www.business.com

Pros And Cons

Xero accounting software offers many benefits but also has some drawbacks. Understanding these pros and cons helps users decide if it fits their needs.

The strengths highlight what makes Xero popular among small businesses. The weaknesses show areas where it may fall short.

Strengths

- Easy to use interface with clear navigation.

- Cloud-based access from any device.

- Automatic bank feeds save time.

- Strong invoicing and billing features.

- Good integration with many third-party apps.

- Real-time financial reporting and dashboards.

- Collaboration with accountants is simple.

- Regular updates improve functionality.

Weaknesses

- Costs can rise with more users or features.

- Limited payroll options outside certain countries.

- Customer support response can be slow.

- Learning curve for advanced features.

- No built-in project management tools.

- Occasional syncing issues with bank feeds.

- Some users find reporting less customizable.

Suitability For Business Types

Xero accounting software fits many types of businesses well. Its features adapt to different needs and sizes. This section explores how suitable Xero is for various business types. It helps in making clear choices based on business size and work style.

Small Businesses

Xero suits small businesses that need easy bookkeeping. It offers tools for invoicing, expense tracking, and bank reconciliation. These features save time and reduce errors. Small businesses benefit from its simple interface. It does not require deep accounting knowledge. Xero also supports multiple users with different access levels.

Freelancers

Freelancers find Xero useful for managing income and expenses. It helps create professional invoices quickly. Tracking payments and due dates becomes easier. Freelancers can connect bank accounts for automatic updates. Xero offers mobile apps to manage accounts on the go. This flexibility suits independent workers well.

Medium Enterprises

Medium enterprises gain from Xero’s scalable features. It handles more complex accounting tasks and multiple users. Reporting tools provide insights into financial health. Integration with other business apps improves workflow. Payroll management and project tracking are available. These functions support growing companies with expanding needs.

Credit: todaytesting.com

Frequently Asked Questions

What Features Does Xero Accounting Software Offer?

Xero offers invoicing, bank reconciliation, payroll, inventory tracking, and financial reporting. It supports multi-currency and integrates with many apps. The software suits small to medium businesses aiming for streamlined accounting and real-time financial insights.

Is Xero Easy To Use For Beginners?

Yes, Xero has an intuitive interface designed for users without accounting experience. It offers helpful tutorials and a user-friendly dashboard. This simplicity helps small business owners manage finances efficiently without needing expert knowledge.

How Secure Is Xero For Financial Data?

Xero uses advanced encryption and multi-factor authentication to protect data. It regularly updates security protocols to prevent breaches. Users can trust Xero for safe cloud-based accounting and confidential financial information management.

Can Xero Integrate With Other Business Tools?

Yes, Xero integrates with over 800 business apps, including CRM, payment, and inventory software. This flexibility helps businesses automate workflows and improve overall efficiency across different departments.

Conclusion

Xero Accounting offers many useful features for small businesses. It is simple to use and helps save time on bookkeeping. Users appreciate its clear reports and easy bank connections. Some may find costs a bit high, but the benefits often outweigh this.

Overall, Xero can help manage finances smoothly and keep things organized. Try it out to see if it fits your needs well.